- News Front Page

- Uncategorized

- Headline News

- Filipino Calgarian

- Business

- Pinoy Stories

- Community News

- Publisher's Note

- The Main Ingredient

- Views and Opinions

- Maikling Kwento

- Alberta News

- OFW – Month

- Travel News

- Health and Lifestyle

- Pinoy Toons

- Pinoy Spirit

- Entertainment

- The Philippine Lawyer

- Horoscope

- Greetings

- About Us

- Greetings From the Prime Minister

- Greetings from the President of the Philippines

- Greetings from the Premier of Alberta

- Greetings from the Mayor of Calgary

- Advertise With Us

- Disclaimer

- Subscription

Publisher's Note

- Publisher’s Note

by CK

May is the month of flowers not just in the Philippines but also here in Calgary. A lot of my neighbors have done their spring cleaning and unfortunately I cannot cope up with them. I remember that during this time of the year my husband, Hank gets busier day by day. He takes care [...]

by CK

May is the month of flowers not just in the Philippines but also here in Calgary. A lot of my neighbors have done their spring cleaning and unfortunately I cannot cope up with them. I remember that during this time of the year my husband, Hank gets busier day by day. He takes care [...]

Visitors to Pinoytimes

Page added on March 28, 2013

TAX CLINIC OFFERING BY CIWA

A Great Guide for Newcomers

By: Tata Tasky Gascon-Delos Reyes

The Catholic Immigrant Women’s Association (CIWA) opened an invitation to its roster of Newcomers last Saturday March 2, 2013 and was held at the Calgary Public Library – Forest Lawn location. Both CIWA and CPL offered this tax clinic in order to assist both the new immigrants and new residents of Calgary.

Moderator was former CRA Auditor Raquel Garalde. Together with her husband Glenn Garalde, who are both experienced and knowledgeable in the field Accountancy and Tax Preparations, the couple answered many questions that lures in the minds of these newcomers. The Why’s of filing income tax return in Canada and the various income and expense attributable to taxation were well explained. The need to file an annual tax return both by income and non-income earners is crucial in determining what provincial benefits may be available and eligible for an individual. Thus, clinic of this kind is very important in order for the newcomers to understand the importance of tax filing.

It was well attended by different nationalities and races that were welcomed in 2012 by Canada and are now living in the City of Calgary. The basic information on the 4-page T1 General, the 2-page Federal tax calculation page, and the 2-page Alberta (AB428) Provincial tax calculation, were presented in a manner that most will understand. An enlightening and eye-opener type of presentation, the attendees at the end realized their responsibility to the Government of Canada.

Although many accepted the concept of taxation, a good number of them still headed for the call of support by CIWA in doing their returns. Thus, the Garalde team, who also owns and runs their own tax preparation firm, KALEIDOSCOPE Accounting, offered to do up to 20 free tax returns to all low-income Newcomers, a commendable move by our “kababayans” alright. The spirit of “Bayanihan” even to those who are non-Filipinos were extended. Another good-spirited tax preparer, Mrs. Joan Vispo, also committed her services for another 10 free basic returns. They were asked to enlist with CIWA and the Association will make the necessary arrangement in order to help them file their 2012 tax returns.

Another tax clinic is slated for March 23rd at the CIWA Office in downtown Calgary. Although everyone is encouraged to learn the basic computation through free forms and guide available all over the City (through Canada Post Stations), it is understandable that many will still need aide in doing such. Thus, there are available tax preparations software, or head to the nearest tax preparation office but service fee applies. Please be reminded that the deadline for this practice is on April 30th 2013 (for individual tax filers), and June 30th 2013 (mostly) for ones with business or professional income claims. see gallery_shortcode() in wp-includes/media.php

RELATED STORIES

LATEST HEADLINES

- Alberta implements provisional ban on temporary foreign workers

- April 2017 photo enforcement locations

- New support for Alberta’s women entrepreneurs

- Miss Universe France Iris Mittenaere Crowned MISS UNIVERSE 2016

- Growth of good jobs for Canadians the goal of the Global Skills Strategy

COMMUNITY NEWS

WHAT IS THERE TO LOSE?

WHAT IS THERE TO LOSE? Changes to Regulations Will See Age Increased for Dependent Child

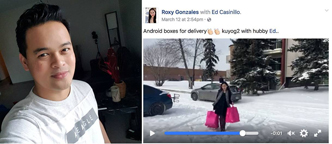

Changes to Regulations Will See Age Increased for Dependent Child ABS-CBN Files $5M Lawsuit Against Casinillo and Gonzalez For Selling Pirated Set-Top Boxes in Edmonton, Canada

ABS-CBN Files $5M Lawsuit Against Casinillo and Gonzalez For Selling Pirated Set-Top Boxes in Edmonton, Canada Forever in our Hearts

Forever in our HeartsPINOY STORIES

More Pinoys enjoys Kapamilya Shows via ABS-CBN TV Plus

More Pinoys enjoys Kapamilya Shows via ABS-CBN TV Plus- Holy Week practices in the Philippines

PINOY SPIRIT

HAVE YOUR SAY

Lorem ipsum dolor sit amet, consectetur adipiscing elit, dolor sit ipsum.PROMOTIONAL BLOCK

Lorem ipsum dolor sit amet, consectetur adipiscing elit, dolor sit ipsum.TRAVEL NEWS

PINOY TOONS

Tags

Archives