- News Front Page

- Uncategorized

- Headline News

- Filipino Calgarian

- Business

- Pinoy Stories

- Community News

- Publisher's Note

- The Main Ingredient

- Views and Opinions

- Maikling Kwento

- Alberta News

- OFW – Month

- Travel News

- Health and Lifestyle

- Pinoy Toons

- Pinoy Spirit

- Entertainment

- The Philippine Lawyer

- Horoscope

- Greetings

- About Us

- Greetings From the Prime Minister

- Greetings from the President of the Philippines

- Greetings from the Premier of Alberta

- Greetings from the Mayor of Calgary

- Advertise With Us

- Disclaimer

- Subscription

Publisher's Note

- Publisher’s Note

It was 22 years ago when I arrived in Canada and chose Calgary, Alberta to be my home. Leaving my family and friends behind, it was a new adventure for me to be in a new country without knowing anyone. That was the time I looked for a Filipino community paper and never found any, [...]

It was 22 years ago when I arrived in Canada and chose Calgary, Alberta to be my home. Leaving my family and friends behind, it was a new adventure for me to be in a new country without knowing anyone. That was the time I looked for a Filipino community paper and never found any, [...]

Visitors to Pinoytimes

Page added on April 19, 2011

Immigration News – Remittances seen as ‘People Power investment’

by ISAGANI DE LA PAZ and JEREMAIAH M. OPINIANO

OFW Journalism Consortium

MANILA–NOW’S the time to leverage a huge potential for Philippine development: remittance of overseas Filipinos, which an economist described as real People Power-inspired investment.

“As it was after the People Power uprising 25 years ago, the money of overseas Filipinos was larger than foreign direct investments at three percent of gross domestic product as against an FDI-to-GDP of less than two percent. This buffered a balance of payments problem that could have been severe that time,” Alvin Ang of the University of Santo Tomas said.

Ang spoke to the OFW Journalism Consortium two days before government commemorated a protest 25 years ago that ousted then-President Ferdinand Marcos and brought to power the mother of current President Benigno Simeon Aquino III.

He noted that even if the size of OFs was still small at around 360,000 in 1986, the money they spent helped an economy described by Ibon Foundation Inc. research head Jose Enrique Africa as a hostage by a few wealthy families.

“Politically, Filipinos were emboldened to oppose the Marcos dictatorship upon years of determined struggle… Economically, people saw that a handful of local and foreign elites were prospering amid high unemployment and widespread poverty,” Africa said in an electronic mail.

Ang said that had there been an absence of remittances from OFs, the BOP crisis could have been more severe because of the myriad requirements for import cover.

Ang cited a World Bank estimate of the size of savings by overseas Filipinos as cue for government to begin ways of luring these funds for investment in view of an estimated BOP deficit of three percent of GDP this year.

The estimated US$21.1 billion worth of “diaspora savings,” says a February 1 World Bank brief, is “huge,” and thus there is no reason why rural areas should not respond to such huge resource which their townmates based abroad have, Ang said.

“These people abroad have ‘hometown empathy’, so it’s logical for them to invest their remittances in the places where they come from and where their families are. That’s People Power economics, if I may say so.”

Diaspora savings

THE economist’s purview on hometown investment is in response to a “preliminary estimate” of what WB economists Dilip Ratha and Sanket Mohapatra call “diaspora savings”.

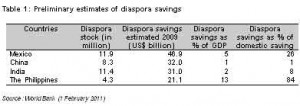

Ratha and Mohapatra’s estimate of diaspora savings in 2009 puts the Philippines as fourth biggest behind Mexico (US$46.9 billion), China (US$32 billion), and India (US$31 billion). These four countries are the world’s biggest recipients of migrant remittances.

Based on the ratio of diaspora saving to these four countries’ GDP and domestic savings, the Philippines stands out among the four countries with 13 percent of GDP and 84 percent of domestic savings [see Table 1].

Source: World Bank (1 February 2011)

If the US$21.1 billion estimate holds, the amount is bigger than the US$17.348 billion of cash remittances sent by some 8.5 million overseas Filipinos to the country in 2009.

The estimated Filipino diaspora savings is just above a third of the country’s 2010 gross international reserves (GIR) which stood at US$62.371 billion, Bangko Sentral ng Pilipinas data show.

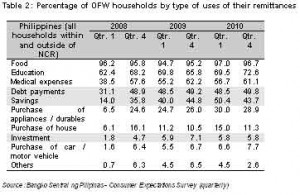

However, in the BSP’s quarterly Consumer Expectations Survey, overseas Filipino workers (OFWs) allocating their remittances to investment cannot catch up with the rising number of OFWs who are saving.

As of CES’s end-2010 result, some 5.8 percent of OFWs set aside their remittances for investment while 43.7 percent of OFWs save their overseas earnings [see Table 2]. In contrast, remittances for debt payments reached 49.8 percent in this same survey round of the CE Survey.

Source: Bangko Sentral ng Pilipinas- Consumer Expectations Survey (quarterly)

Some 2.8 percent of the survey’s OFW respondents within the National Capital Region use their remittances for investment, says fourth-quarter 2010 results. In contrast, 9.5 percent of respondents outside of NCR invest their remittances.

The Philippines, as a whole, has a low domestic savings rate of 15.6, says 2009 data coming from the Asian Development Bank.

The WB Migration and Remittances unit’s “Migration and Development Brief” estimated diaspora savings based on data of “bilateral migrant stocks for 2010” and “assumptions about migrant incomes.”

Ratha and Mohapatra’s estimates sought to determine the size of savings of overseas migrants to gauge the potential market for so-called “diaspora bonds.”

The Philippine government already tested such investment instrument when the Department of Finance floated “OFW bonds” last year, raising some US$346 million in funds. A fifth of those bonds were offered to retail buyers, i.e. OFWs or OFW relatives.

Given such potential, Ang thinks local governments must adjust their areas’ investment climate to accommodate the investment appetite of overseas townmates.

“The question is how ready rural birthplaces of overseas Filipinos are to become hubs of migrant investment should overseas townmates decide to park their money there.”

Ang’s research unit at the University of Santo Tomas is soon piloting a research tool to help overseas Filipinos from two fourth-class rural municipalities to determine investment opportunities in local communities.

OFW Journalism Consortium

RELATED STORIES

LATEST HEADLINES

- ISKWELAHANG PILIPINO (IP) RONDALLA OF BOSTON WINS THE HEARTS OF CALGARIANS

- Pinay doctor joins Medicus Family Clinic and Pharmacy

- Multicultural Ethnic Media round table with Minister of Finance Joe Ceci together with Minister of Social Services Irfan Sabir

- Trans Mountain Pipeline keeps Canada working

- Facilitating travel to Canada while keeping Canadians safe

COMMUNITY NEWS

A new way forward for some immigration application processing times

A new way forward for some immigration application processing times Calgary Stampede 2018 Poster

Calgary Stampede 2018 Poster Alberta celebrates first Philippine Heritage Month

Alberta celebrates first Philippine Heritage Month UPAAA Welcomes New Philippine Consul General

UPAAA Welcomes New Philippine Consul GeneralPINOY STORIES

Duterte signs National ID System Act

Duterte signs National ID System Act- Holy Week practices in the Philippines

PINOY SPIRIT

HAVE YOUR SAY

Lorem ipsum dolor sit amet, consectetur adipiscing elit, dolor sit ipsum.PROMOTIONAL BLOCK

Lorem ipsum dolor sit amet, consectetur adipiscing elit, dolor sit ipsum.TRAVEL NEWS

PINOY TOONS

Tags

Archives