- News Front Page

- Uncategorized

- Headline News

- Filipino Calgarian

- Business

- Pinoy Stories

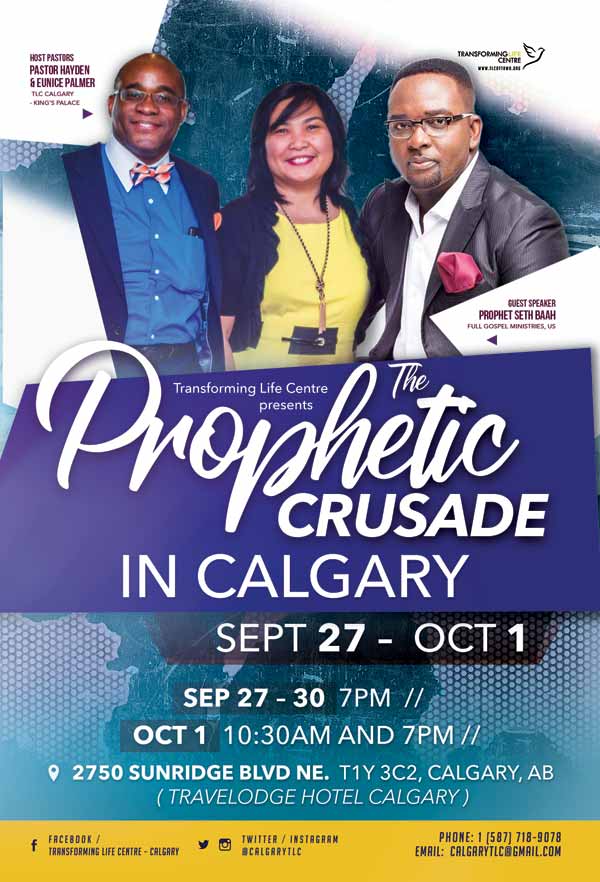

- Community News

- Publisher's Note

- The Main Ingredient

- Views and Opinions

- Maikling Kwento

- Alberta News

- OFW – Month

- Travel News

- Health and Lifestyle

- Pinoy Toons

- Pinoy Spirit

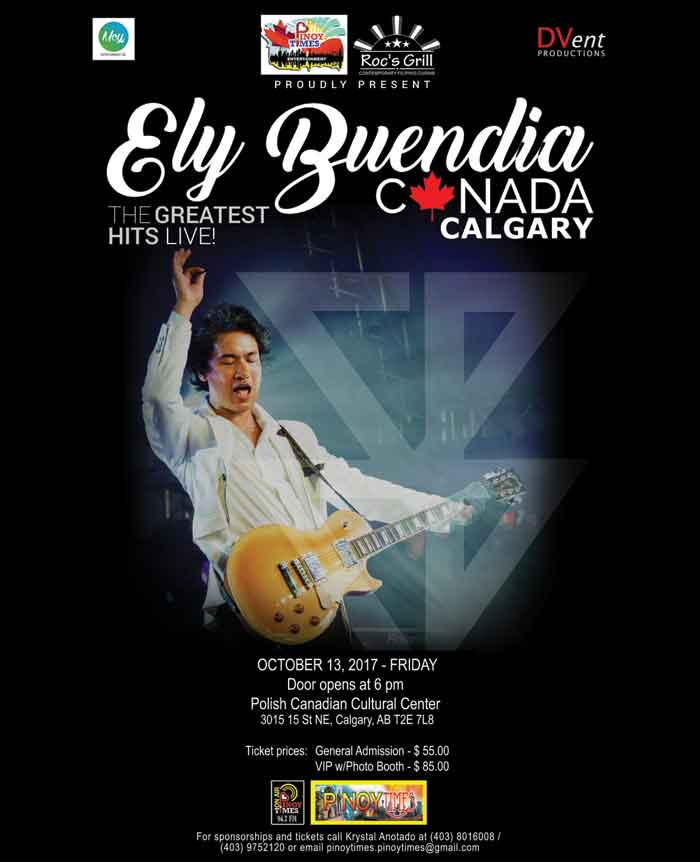

- Entertainment

- The Philippine Lawyer

- Horoscope

- Greetings

- About Us

- Greetings From the Prime Minister

- Greetings from the President of the Philippines

- Greetings from the Premier of Alberta

- Greetings from the Mayor of Calgary

- Advertise With Us

- Disclaimer

- Subscription

Publisher's Note

- Publisher’s Note

Email a copy of 'Publisher's Note' to a friend

Loading ...

Loading ...

Visitors to Pinoytimes

Page added on January 22, 2010

Home Renovation Tax Credit (HRTC)

What is the HRTC?

Under proposed changes, the HRTC is a non-refundable tax credit based on eligible expenditures incurred for work performed, or goods acquire, after January 27, 2009, and before February 1 2010, under an agreement entered into after January 27, 2009. The HRTC can be claimed when filing your 2009 tax return.

The HRTC can be claimed for the renovations and alternations of an enduring nature and that are integral to the eligible dwelling (such as your home or cottage) or the land that forms part of the eligible dwelling.

How is the HRTC calculated?

The 15% non refundable tax credit can be claimed on eligible expenditures of more than $1,000 but not more than $10,000. The maximum tax credit that can be claimed to reduce your federal income tax is $1,350. However, if the total of your non refundable tax credit is more than your federal income tax, you have no federal income tax to pay, and you will not receive a refund for the HRTC.

Example

William and his spouse Marie pay $5,000 to purchase an energy-efficient furnace for their home and $3,500 to build a deck at their cottage. They also decide to have the area around the deck landscaped for $2,500, bringing their total costs to $11,000 ($5,000+$3,500+$2,500). Marie claims expenses of $9,000 ($10,000-$1,000) resulting in an HRTC of $1,350.

William and Marie may also be eligible for the ecoENERGY Retrofit-Homes grant. For more information about the ecoENERGY programs, visit www.ecoaction.gc.ca

Important things to remember

You do not have to submit your supporting documents with your income tax and benefit return; however, you must ensure this information is available should the Canada Revenue Agency request it.

To avoid problems with your HRTC claim, make sure you:

- Get your contracts in writing and

- Keep your receipts.

Examples of eligible expenses

- Renovating a kitchen, bathroom, or basement

- New carpet or hardwood floors

- Building an addition, garage, deck, garden/storage shed, or fence

- Re-shingling a roof

- A ne furnace, woodstove, boiler, fireplace, water softener, or water heater

- A new driveway or resurfacing a driveway

- Painting the interior or exterior of a house

- Window coverings directly attached to the window frame and whose removal would alter the nature of the dwelling.

- Laying new sod

- Swimming pools (permanent – in ground and above ground)

- Fixtures (e.g., lights, fans, etc.)

- Associated costs such as permits, professional services, equipment rentals, and incidental expenses

Examples of Ineligible expenses

- Furniture, appliances, and audio and visual electronics

- Purchasing of tools

- Carpet cleaning

- Maintenance contracts (e.g., furnace cleaning, snow removal, lawn care, and pool cleaning)

- Financing costs

Where can I get more information?

For more information, go to www.cra.gc.ca/hrtc or www.hiringcontractor.com, or call us at 1-800-959-8281.

FEATURES, VIEWS & REVIEWS

The Main Ingredient

Ingredients to satisfy most of our tastebuds

Views & Opinions

Different views and opinions

Maikling Kuwento Atbp

Short stories from our contributors

LATEST HEADLINES

- Pilot program for newcomers launching companies in Canada to be made permanent

- Citizenship Bill Receives Royal Assent

- Improvements to the Express Entry

- Alberta implements provisional ban on temporary foreign workers

- April 2017 photo enforcement locations

COMMUNITY NEWS

ABS-CBN is most awarded TV Network at the 15TH PHILIPPINE QUILL AWARDS

ABS-CBN is most awarded TV Network at the 15TH PHILIPPINE QUILL AWARDS Independence Day Message from Secretary of DTI

Independence Day Message from Secretary of DTI WHAT IS THERE TO LOSE?

WHAT IS THERE TO LOSE? Changes to Regulations Will See Age Increased for Dependent Child

Changes to Regulations Will See Age Increased for Dependent ChildPINOY STORIES

PhilHealth seeks to increase premium contributions to P3,600

PhilHealth seeks to increase premium contributions to P3,600- Holy Week practices in the Philippines

PINOY SPIRIT

HAVE YOUR SAY

Lorem ipsum dolor sit amet, consectetur adipiscing elit, dolor sit ipsum.PROMOTIONAL BLOCK

Lorem ipsum dolor sit amet, consectetur adipiscing elit, dolor sit ipsum.TRAVEL NEWS

PINOY TOONS

Tags

Archives